I believe most people start this kind of plan in January.

It’s a new beginning, a new year, and resolutions have been made. Maybe saving

money was one of those resolutions. That means a person has to set aside $388

total in November and December, the holiday season. Whether it be on holiday

gifts or cooking/baking supplies, we as consumers spend more money and have

less disposable income during those months. I make several pecan pies during

the holidays and pecans are expensive! Let’s not even start on the gifts.

Suddenly, the $388 sounds like quite a bit.

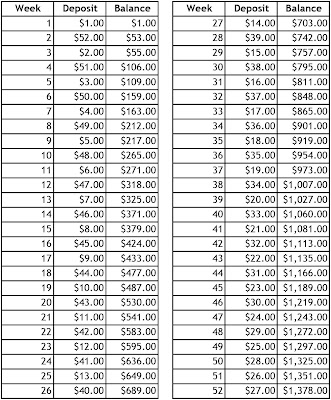

My solution? Take the traditional schedule and alternate

between the front end of it and the back. Check out the new schedule below to

see! The contributions for the last two months now total $212, essentially

putting $176 back into your disposable income for that time period AND you’re

still on track with the savings plan.

I think the majority of us earn incomes that don’t

fluctuate much from month to month. Your savings plan shouldn’t either.

No comments:

Post a Comment